ACCRA, March 29 (Reuters) – Ghana’s parliament approved a new 1.5% tax on electronic payments, known as the “e-levy,” on Tuesday after the opposition walked out in protest.

Finance Minister Ken Ofori-Atta proposed the e-levy in November to widen the tax net and has presented it as a panacea for Ghana’s raft of financial woes. Opposition was so fierce that it caused a brawl in parliament a month later.

Critics believe the e-levy will price lower-income people and small business owners out of the digital economy, while Ofori-Atta said it was a way to ensure Ghanaians “contribute their fair share” toward development.

Ruling members of parliament re-introduced the bill on Tuesday, when many opposition MPs were not present, a surprise move analysts had previously said would be one of the only ways for the tax to pass. read more

It was expected to be re-submitted next week, but parliament speaker Alban Bagbin said it should be treated as an urgent business and fast-tracked it.

“The financial institutions of this country should not be subject to this punitive, insensitive tax. It would be a disincentive to the private sector of Ghana,” minority leader Haruna Iddrisu said in a statement in parliament.

After he spoke, opposition parties walked out, refusing to take part in the vote.

The tax, which would cover mobile money payments, bank transfers, merchant payments, and inward remittances, could raise up to 6.9 billion Ghanaian cedi ($926 million) in 2022, according to government estimates.

Analysts have said that the passage of the e-levy could reassure investors and lenders of Ghana’s ability to make tough choices to generate revenue, helping to narrow government bond spreads.

Markets reacted immediately after the tax passed. Prices on Ghanaian Eurobonds rose by as much as 2.77 cents on the dollar, reaching their highest value since the day before Russia invaded Ukraine.

But analysts say additional fiscal measures may prove necessary for Ghana to reverse its recent economic misfortunes.

Ghana, one of West Africa’s largest economies, is facing rampant inflation, a depreciating currency and a heavy debt burden. Its credit ratings have been downgraded over concerns about the government’s ability to pass legislation to raise revenues.

“Regaining market access will probably require a series of strong fiscal data over the course of the next several months,” said Amaka Anku, consultancy Eurasia Group’s Africa practice head. “The e-levy will help but is not dispositive.”

Consumer inflation reached 15.7% year on year in February, the highest since 2016. The cedi depreciated some 20% against the dollar this year, second only to the Russian rouble, and public debt hovers around 80% of gross domestic product.

What is E-Levy?

Electronic Transaction Levy (commonly known as Electronic Levy or E-levy) is a tax applied on transactions made on electronic or digital platforms

E-Levy Proposal By Ghana Government

On 17 November 2021, Ken Ofori-Atta said the Government of Ghana decided to tax all electronic transactions in the informal sector to cover the tax net. He made this known in the 2022 budget statement and economic policy that was read in the parliament of Ghana. 1.75% is the rate of the E-levy which the Government decided to apply on all transactions. Ken Ofori-Atta said it could raise about $1.15billion which will widen the tax net. According to John Kumah, the money generated from the levy would be used for the payments of contractors in Ghana.Also, revenue from the levy would be used to support entrepreneurship, cyber and digital security; road infrastructure and provide jobs to about 11million people in the country. The Government of Ghana said that the introduction of the levy was due to the rise of the use of digital platforms for transactions because of the COVID-19 pandemic.

E-Levy Transactions

It was proposed the E-levy would cover the following transactions:

- All inward remittances (which would be paid by the recipient)

- All person-to-person (P2P) mobile transactions (which includes sending of funds to another account, payment for goods and services, payment of utilities

- All POS/Merchant payments.

Government E-Levy Charges On MoMo Transactions

| MoMo Value | E-Levy Charges (1.5%) |

|---|---|

| Less Than GH¢ 100 | GH¢ 0.00 |

| GH¢ 150 | GH¢ 2.25 |

| GH¢ 300 | GH¢ 4.50 |

| GH¢ 500 | GH¢ 7.50 |

| GH¢ 1000 | GH¢ 15.00 |

| GH¢ 2000 | GH¢ 30.00 |

| GH¢ 5000 | GH¢ 75.00 |

Telcos Tax Charges on MoMo Transactions

| MoMo Value | Telco or Sim Company Charges (0.75%) |

|---|---|

| Up to GH¢ 100 | GH¢ 0.75p |

| GH¢ 150 | GH¢ 1.125 |

| GH¢ 300 | GH¢ 2.25 |

| GH¢ 500 | GH¢ 3.75 |

| GH¢ 1000 | GH¢ 7.50 |

| GH¢ 2000 | GH¢ 15.00 |

| GH¢ 5000 | GH¢ 37.00 |

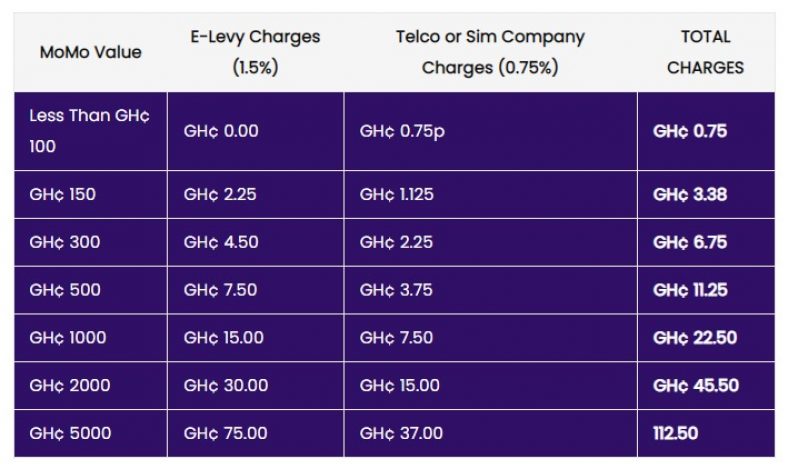

Total Amount of E-Levy to Pay on MoMo Transactions

| MoMo Value | E-Levy Charges (1.5%) | Telco or Sim Company Charges (0.75%) | TOTAL CHARGES |

|---|---|---|---|

| Less Than GH¢ 100 | GH¢ 0.00 | GH¢ 0.75p | GH¢ 0.75 |

| GH¢ 150 | GH¢ 2.25 | GH¢ 1.125 | GH¢ 3.38 |

| GH¢ 300 | GH¢ 4.50 | GH¢ 2.25 | GH¢ 6.75 |

| GH¢ 500 | GH¢ 7.50 | GH¢ 3.75 | GH¢ 11.25 |

| GH¢ 1000 | GH¢ 15.00 | GH¢ 7.50 | GH¢ 22.50 |

| GH¢ 2000 | GH¢ 30.00 | GH¢ 15.00 | GH¢ 45.50 |

| GH¢ 5000 | GH¢ 75.00 | GH¢ 37.00 | 112.50 |